Vector Autoregressive Models

These two products are known for their substantial influence on global economy.

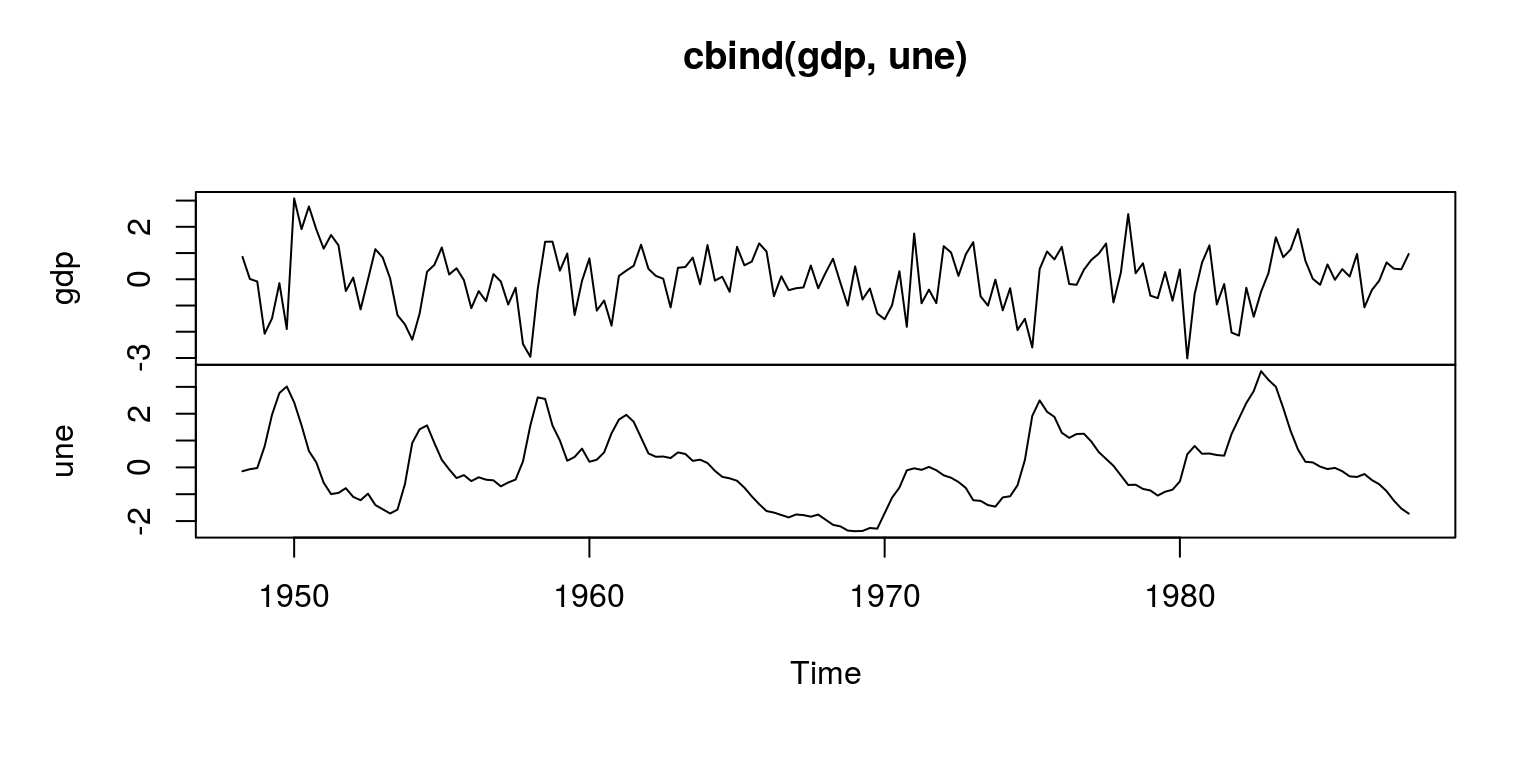

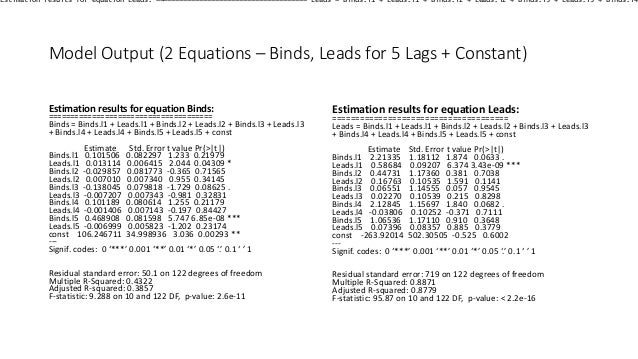

Vector autoregressive models. Vektorautoregressive modelle kurz var modelle sind sehr weit verbreitete ökonometrische modelle zum simultanen schätzen mehrerer gleichungen. It is a natural extension of the univariate autoregressive model to dynamic mul tivariate time series. In conventional structural vector autoregressive models it is assumed that there are at most as many structural shocks as there are variables in the m. Vector autoregressive models for multivariate time series 11 1 introduction the vector autoregression var model is one of the most successful flexi ble and easy to use models for the analysis of multivariate time series.

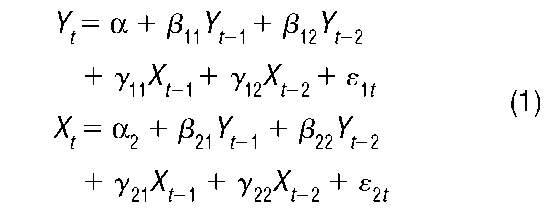

Estimation consider the var 1 y 1t 1 a 11y 1t 1 a 12y 2t 1 u 1t y 2t 1 a 21y 1t 1 a 22y 2t 1 u 2t where cov u 1t u 2s 12 for t s. Umberto triacca lesson 17. The development of the series should be explained by the common past of these variables. At its core the var model is an extension of the univariate autoregressive model we have dealt with in chapters 14 and 15.

That means the basic requirements in order to use var are. A vector autoregressive var model is useful when one is interested in predicting multiple time series variables using a single model. All variables in a var enter the model in the same way. That means the explanatory variables in the simplest model are y1 t 1and y2 t 1.

Umberto triacca lesson 17. Var stands for vector autoregression. Sie sind das mehrdimensionale analogon zum autoregressiven modell. Var models generalize the univariate autoregressive model by allowing for more than one evolving variable.

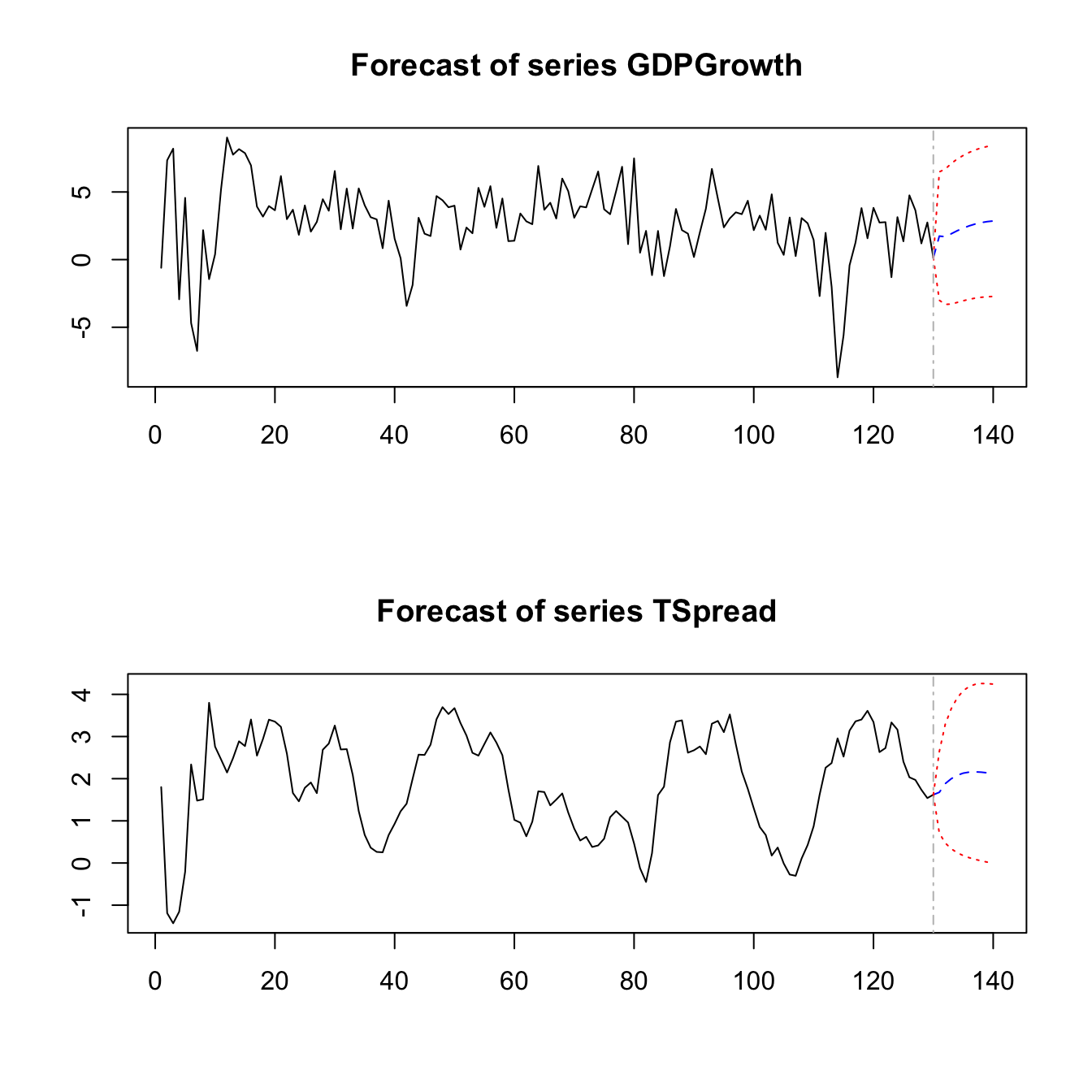

Vector autoregression var is a multivariate forecasting algorithm that is used when two or more time series influence each other. I will show here how to use granger s causality test to test the relationships of multiple variables in the time series and vector auto regressive model var to forecast the future gold oil. Key concept 16 1 summarizes the essentials of var. Vector autoregression is a stochastic process model used to capture the linear interdependencies among multiple time series.

Estimation in this lesson the estimation of a vector autoregressive model is discussed. Var modeling does not require as much knowledge about the. The most easy multivariate time series model is the bivariate vector autoregressive model with two dependent variables y1 tand y2 t where t 1 t. To understand what this means let us first look at a simple univariate i e only one dependent or endogenous variable autoregressive ar model of the form y t a 1 y t 1 e t.

Umberto triacca lesson 17.